5 Best Courier Insurance in 2024

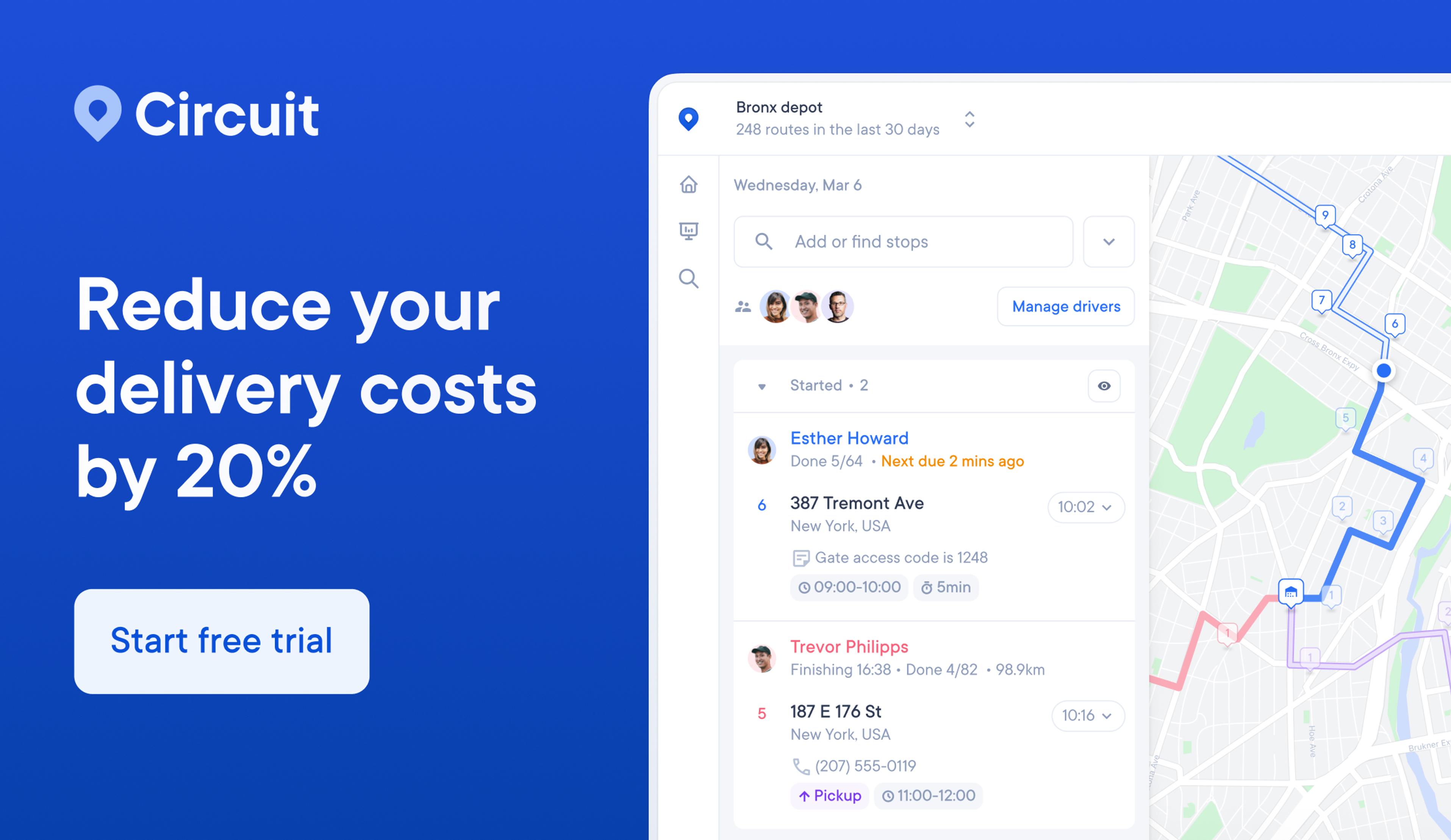

Optimize your courier business with Circuit for Teams and enhance route efficiency and safety.

As a courier business owner, you know firsthand how critical reliable insurance is to your operation.

The landscape of delivery services, influenced by major players like Amazon and Uber, has shifted insurance needs.

This article will walk you through the top courier insurance options currently available.

We'll focus on coverage essentials like liability and goods in transit to help you choose the insurance that best fits your business needs in today's market.

Key takeaways

- Choose courier insurance that aligns with your specific business needs, like cargo type, team size, and operation scale.

- Pay close attention to coverage limits, exclusions, and policy terms for adequate protection.

- Shop around and compare different insurance providers, focusing on their coverage options, customer service, and the additional benefits they offer.

- Efficiently managing risks through proper insurance coverage can significantly impact your business's financial stability and operational success.

Top 5 courier insurance to consider

- Progressive: Customizable plans

- Reliance Partners: Specialized for trucking

- Thimble: On-demand policies

- Insureon: Small business focus

- Insurance Office of America: Comprehensive business coverage

Factors to consider when choosing courier insurance

Here are the key aspects to consider when selecting courier or delivery insurance.

Insurance coverage options

As a courier or food delivery business owner, be aware of the several insurance coverage options:

- Liability insurance. This essential insurance covers costs if your operations cause injury to others or damage their property. Whether you're delivering packages or food, your drivers are constantly interacting with the public, which increases the risk of such incidents.

- Property damage. This coverage is crucial for any accidents that result in damage to property, including those caused by your vehicles. It's especially important if your courier operations involve navigating busy urban areas or handling fragile goods.

- Bodily injury. This covers injuries that might occur to others due to your business activities. Given the nature of delivery services, where your drivers are on the road frequently, this coverage is particularly important to consider.

It's also vital to differentiate between personal auto insurance and commercial auto insurance. Personal auto policies typically don't cover incidents during commercial activities like deliveries.

Get commercial or business auto insurance to cover your vehicles and drivers adequately. Pay attention to policy limits, as they dictate the maximum amount your insurer will pay in the event of a claim, which is crucial for adequately protecting against financial losses for your business.

Cost and affordability

When selecting insurance for your business, it's important to balance cost with the right level of coverage.

Here are some key points to keep in mind:

- Get multiple quotes. Get a quote from each insurance provider you’re considering and compare to find the best rate that fits your business needs. Different insurers might offer different premiums for the same level of coverage.

- Understand the factors affecting cost. Your insurance premium is influenced by factors like the deductible amount and the nature of your business use. A higher deductible can lower your premium, but it means higher out-of-pocket costs in the event of a claim. Also, how and where you use your vehicles for business affects your cost.

- Look for small business-friendly options. If you run a small courier or delivery business, seek out insurance providers that cater to small businesses. They might offer more appropriate coverage options and pricing for your type of business.

Remember, the cheapest insurance option isn’t always the best choice. Consider what you're getting for the price and make sure it adequately covers your business risks.

Types of goods in transit

The type of goods you transport significantly influences your insurance needs.

Understanding the nature of your typical cargo is essential in selecting the right insurance coverage.

- High-value items. If your business transports items of high value, like electronics or jewelry, you'll need insurance that offers sufficient coverage for these goods. The risk of theft or damage is higher, which can increase the insurance cost.

- Hazardous materials. Transporting hazardous materials comes with its own set of risks and legal needs. Insurance for hazardous goods typically includes additional coverage for spills or accidents that could cause environmental or public health issues.

- Perishable goods. If your business specializes in delivering perishable items like food or flowers, you need insurance that covers spoilage or damage due to temperature changes, delays, or equipment failure.

Not all policies automatically include coverage for high-value, hazardous, or perishable items, so verify your coverage with your insurance provider.

Customer service and support

As you evaluate insurance providers for your courier or delivery business, pay close attention to their customer service, especially in terms of handling claims and resolving disputes.

- Claims handling. Choose an insurance provider with a reputation for handling claims efficiently and fairly. Delays or complications can disrupt your operations and financial health.

- Dispute resolution. You want an insurance provider that resolves disagreements over policy interpretations or claim values transparently and equitably. A provider with a cumbersome dispute resolution process can add unnecessary stress and time delays.

Remember, in a business where time is money, the speed and effectiveness of your insurance provider can be as crucial as the coverage they offer.

Coverage limits and exclusions

As a courier business owner, it's essential to understand the limitations and exclusions in your insurance policy, especially regarding what happens in the event of an accident.

- Coverage limits. Your policy has a maximum payout limit for claims. For example, if your coverage limit is $100,000 and an accident claim costs $150,000, you'll need to pay the extra $50,000 out of pocket. Make sure your coverage limit is high enough to safeguard your business's finances.

- Exclusions. Know what your policy doesn’t cover. Common exclusions include damage from wear and tear or specific types of goods that are not covered under cargo insurance. If an accident involves these excluded scenarios, you will be financially responsible.

Review your policy's limits and exclusions carefully. If there's something you don't understand or an area that doesn't cover your business needs, talk to your insurance provider.

Additional services and benefits

When selecting your courier insurance policy, consider the value of add-on services offered by insurance companies. These extras can enhance the effectiveness of your coverage and support your business operations.

- Tracking systems. Insurance providers may offer tracking systems. Beyond vehicle recovery, these can improve route efficiency and safety, potentially reducing your insurance premiums by lowering risk.

- Courier assistance services. Some policies include assistance services like roadside help, legal advice, or emergency cover. These can be crucial in minimizing operational disruptions during unexpected incidents.

Weigh the benefits of these value-added features against their cost. While they might increase your premium, the potential operational benefits and risk reduction can be a wise investment for your business.

1. Progressive

Progressive's courier driver insurance addresses the specific needs of courier and delivery drivers through comprehensive coverage options.

This insurance covers a range of scenarios, including vehicle damage, liability for bodily injuries and property damage, and goods in transit.

A standout feature is their flexibility in policy customization, allowing you to tailor coverage based on your unique business needs.

Pros:

- Customizable coverage. Policies can be tailored to your specific business needs, making sure you only pay for what you need.

- Bundling options. Progressive offers the ability to bundle different types of insurance, potentially leading to cost savings.

- Roadside assistance. Available as an add-on, which can be crucial for drivers in case of vehicle breakdowns or emergencies.

- Nationwide coverage. Progressive has a wide reach, offering insurance solutions across various states, which is beneficial for businesses operating in multiple regions.

Cons:

- Premium costs. Customization and extensive coverage options can lead to higher premiums compared to basic policies.

- Complexity in policy selection. With numerous options available, choosing the right coverage can be overwhelming without proper guidance.

- Claims process. Some users report a lengthy claims process, which can be a drawback for businesses needing quick resolutions.

- Specific exclusions. Certain scenarios or types of goods may not be covered under standard policies, so carefully review policy details.

2. Reliance Partners

Reliance Partners specializes in courier insurance with a strong focus on the trucking and delivery sector.

Their insurance covers a broad spectrum, including general liability insurance for bodily injury and property damage, cargo insurance, and coverage for physical damage to vehicles.

Reliance Partners’ deep expertise in the trucking industry allows them to offer policies that are highly tailored to the needs of courier and trucking businesses.

Pros:

- Industry-specific expertise. Specialized knowledge in trucking and courier services creates tailored insurance solutions.

- Many types of coverage. Offers a comprehensive array of coverage, from standard auto liability to specific cargo insurance needs.

- Customizable policies. Ability to customize policies to fit specific business needs, including varying sizes and types of courier operations.

- Support and guidance. Gives expert advice and support, helping businesses understand and choose the right auto coverage.

Cons:

- Potentially higher cost for specialized coverage. Specialized, comprehensive coverage can come at a higher cost compared to basic insurance plans.

- Complexity for smaller operations. Businesses with simpler needs might find the extensive options more complex than necessary.

- Availability. Services and specific coverage options might vary depending on the region and the size of the operation.

- Focused on larger operations. Smaller courier services might find the focus on trucking and large-scale operations less relevant to their needs.

3. Thimble

Thimble has a flexible, convenient approach to courier driver insurance.

Their coverage primarily includes general liability, which protects against third-party claims of bodily injury, property damage, and personal and advertising injury.

A standout feature of Thimble is their on-demand insurance model, allowing couriers to get coverage for as short as a single day or for longer periods.

Pros:

- Flexible coverage terms. Unique pay-as-you-go model, ideal for couriers needing short-term or intermittent insurance.

- Fast and easy setup. Streamlined process for obtaining coverage allows you to get insured in minutes.

- Customization options. Offers the ability to tailor coverage dates and limits according to your specific business activities.

- Convenient online management. Policies can be managed entirely online, adding to the ease of use.

Cons:

- Limited coverage scope. Primarily focuses on general liability coverage, which might not be comprehensive enough for some courier businesses.

- Not suitable for large teams. More appropriate for individual couriers or small operations and may not suit businesses with large teams of drivers.

- Variable pricing. While flexible, the cost can vary significantly based on the duration and extent of coverage.

- Dependent on business nature. The suitability and cost-effectiveness depend heavily on the specific nature and frequency of your courier operations.

4. Insureon

Insureon offers commercial auto insurance tailored to the needs of courier and delivery drivers.

Their policies cover a range of needs, including liability for bodily injury and property damage, collision damage, and uninsured motorist coverage.

A notable aspect of Insureon is its focus on small businesses, offering policies that are particularly suited to the unique challenges and risks faced by smaller courier operations.

Pros:

- Small business specialization. Policies are specifically designed to meet the needs of small courier and delivery businesses.

- Comprehensive coverage options. Includes a wide range of coverage types, such as liability, collision, and uninsured motorist protection.

- Online quote and purchase process. Streamlined, user-friendly online system for obtaining quotes and purchasing policies.

- Personalized support. Access to experienced agents who can give tailored advice and support based on your specific business needs.

Cons:

- May be costly for very small operations. While focused on small businesses, the costs may still be high for very small or individual courier operations.

- Limited options for larger teams. May not offer the level of coverage or customization that larger courier and delivery companies need.

- Policy complexity. The range of options and coverages can be complex to navigate for those new to business insurance.

- Dependence on online management. Heavy reliance on online management might not suit customers who prefer in-person interactions.

5. Insurance Office of America (IOA)

Insurance Office of America (IOA) offers comprehensive courier insurance solutions tailored to a wide range of delivery services.

Their coverage extends to general liability, commercial auto insurance, workers’ compensation, and cargo insurance.

A distinctive feature of IOA is their consultative approach, where they work closely with clients to identify specific risks and tailor coverage accordingly.

Pros:

- Tailored risk assessment. IOA’s personalized approach makes sure that your policy is closely aligned with your specific business risks.

- Wide range of coverage options. From general liability to cargo insurance, IOA covers various aspects crucial for courier services.

- Expertise in multiple industries. Their experience across various industries allows for a more informed insurance solution, beneficial for diverse courier services.

- Workers’ compensation insurance included. Offers workers’ comp coverage for employees, which is essential for courier businesses with a workforce.

Cons:

- Potentially higher premiums. Tailored solutions and extensive coverage options might lead to higher costs.

- Complexity for smaller operations. Small courier services might find the wide range of options more complex than needed.

- Longer setup time. The consultation process can take longer than off-the-shelf options.

- May overlap with existing policies. For businesses with existing coverage, there's a risk of overlap in coverage.

Which courier insurance is best overall?

Determining the best courier insurance overall depends on the specific needs and circumstances of your business.

- For businesses seeking customizable policies and nationwide coverage, Progressive offers comprehensive options and the flexibility to tailor your insurance to your specific needs.

- If your operation is more specialized in trucking and large-scale courier services, Reliance Partners, with their industry-specific expertise, could be the ideal choice.

- For small businesses or individuals needing flexible, short-term coverage, Thimble’s on-demand insurance model is particularly beneficial.

- Insureon stands out for small courier businesses, offering comprehensive coverage options and a user-friendly online management system.

- For a more consultative approach and tailored risk assessment, especially for diverse courier services, IOA is a strong contender.

The best courier insurance for you will align with your business size, nature of operations, specific risk factors, and budget.

Carefully assess your business needs, compare the offerings of these providers, and possibly consult with an insurance expert to make the most informed decision.

Courier insurance FAQ

Navigating the world of courier insurance can be complex. To help clarify some common queries, here are some frequently asked questions about courier insurance.

What does courier insurance cover?

Courier insurance typically covers liabilities such as bodily injury and property damage caused by your courier operations, damages to vehicles and goods in transit, and sometimes includes coverage for legal fees and medical expenses. The extent of coverage can vary depending on the policy.

What is the difference between courier insurance and other types of insurance?

Courier insurance is specifically designed to cover risks associated with courier and delivery services, like goods in transit, high mileage, and frequent stops.

This differs from standard auto insurance, which doesn't typically cover vehicles used for commercial purposes, or general business insurance, which may not adequately cover the unique aspects of courier services.

What should I do if my courier is in an accident?

If your courier is involved in an accident, check everyone's safety first and call emergency services if needed. Document the scene with photos and gather witness information.

Notify your insurance provider as soon as possible to start the claims process. Follow your insurance agent’s guidance on the subsequent steps to take.

Optimize your deliveries with Circuit for Teams

Selecting suitable courier insurance is essential for your business’s protection, but optimizing your delivery operations is just as crucial for efficiency and cost savings.

Circuit for Teams offers a practical solution to enhance your delivery process.

Our app's route optimization feature plans the most efficient delivery routes to save time and reduce fuel expenses and wear on your vehicles, which can help lower insurance claims and costs.

Circuit for Teams also offers effective delivery scheduling. Improved efficiency leads to cost savings and better customer satisfaction due to timely deliveries.

Integrating Circuit for Teams courier software into your delivery operations complements your insurance protection and improves overall business performance.

Sign up at Circuit for Teams and start optimizing your delivery routes and schedules today.