5 Best Delivery Insurance in 2024

Circuit for Teams' route optimization identifies optimal delivery routes, minimizing time on the road, lowering the risk of incidents, and potentially reducing insurance premiums.

If you're a delivery driver or delivery business owner in 2024, understanding and choosing the right auto insurance is crucial for your peace of mind and financial security.

An insurance policy tailored for couriers and delivery drivers is your safeguard against unexpected incidents on the road.

With the growth of companies like Uber Eats, DoorDash, and Amazon Flex, the risks and responsibilities in this field have expanded, particularly for independent contractors and businesses that employ independent contractors.

This article is your guide to navigating the best delivery insurance options this year, whether you're driving independently or insuring your delivery service business.

We'll help you understand what to look for in a policy, making sure you're well-protected in your day-to-day operations.

Key takeaways

- Customized insurance is crucial. Choose a delivery insurance policy that suits your specific needs, whether you’re an independent contractor or insuring drivers for your delivery service.

- Cost vs. coverage balance. Weigh the balance between cost and coverage. Affordable premiums are important, but not at the expense of adequate protection.

- Understand policy details. Pay close attention to coverage limits, exclusions, and add-ons. Knowing what your policy covers and what it doesn’t is vital.

- Service reputation matters. Consider the reputation and financial stability of the insurance provider. Reliable customer service and strong financial health are key indicators of a trustworthy insurer.

Top 5 delivery insurance to consider

- Progressive: Comprehensive coverage

- State Farm: Reliable service

- Allstate: Customizable plans

- GEICO: Affordable rates

- Farmers Insurance: Expert support

Factors to consider when choosing delivery insurance

When selecting delivery insurance, several key factors come into play to make sure you get the coverage that best fits your needs.

Understanding these aspects can help you make an informed decision, whether you're an individual driver or managing a team.

Coverage options

When exploring delivery insurance, understanding the different types of coverage available is crucial.

Here are some key options:

- Liability insurance. This is foundational for any driver. It covers costs associated with damage or injury you may cause to others while on the job. This is especially important for food delivery and rideshare drivers, as they are constantly interacting with other road users and pedestrians.

- Property damage. This coverage helps pay for damages you might cause to someone else's property while operating your vehicle. In the fast-paced world of delivery services, minor accidents can happen, and this coverage makes sure you're protected against such financial liabilities.

- Bodily injury. This part of the policy covers injuries that you, as the driver, may inflict on others in an accident. Given the nature of delivery work, where drivers are often on the road for extended periods, this coverage is vital.

For those in specialized services like food delivery or ridesharing (Uber Eats, DoorDash, Lyft), it's essential to understand the nuances of your food delivery insurance needs.

These roles often need more comprehensive coverage due to the increased risks and liabilities associated with transporting people or goods.

It's also crucial to understand the policy limits of any insurance you consider. These limits define the maximum amount your insurance provider will pay under a covered claim. Knowing these can help you assess if the coverage is sufficient for your needs.

Lastly, differentiate between a personal auto insurance policy and commercial auto insurance. A personal vehicle policy might not give you coverage while you're using your vehicle for business purposes, like deliveries.

In contrast, commercial car insurance is designed specifically for vehicles used for business activities, offering broader and more appropriate coverage for delivery drivers.

Cost and affordability

Choosing the right delivery insurance involves a careful balance between cost and the coverage you need.

Here's what you should consider:

- Get multiple quotes. It's wise to shop around. Different insurance providers, including names like Progressive or State Farm, offer varied rates. Comparing quotes helps you find a policy that fits your budget without sacrificing essential coverage.

- Understand the impact of deductibles. Your insurance cost is significantly affected by the deductible you choose. A higher deductible can lower your monthly premiums, but it also means more out-of-pocket expenses if you file a claim. Consider what you can realistically afford both monthly and in the event of an accident.

- Consider your business use. If you're using your vehicle for business, such as food delivery, expect higher premiums compared to personal use. This is due to the increased risk associated with business activities.

- Special considerations for independent contractors and small business owners. If you're working in food delivery services as an independent contractor or a small business owner, look for insurance options tailored to your specific needs. These policies can often give more appropriate coverage at a better price point than standard commercial policies.

Remember, the goal is to secure insurance that protects you without straining your finances. Take the time to assess your needs and budget accordingly.

Customer service and support

As you choose an insurance provider, pay close attention to their customer service and support. This is crucial for a smooth experience, especially if you need to file a claim or resolve a dispute.

Here's what this means for you:

- Responsive claims process. You want an insurer that handles claims efficiently and fairly. A good service will guide you through the claims process, making it as stress-free as possible. This is vital when you're dealing with the aftermath of an incident on the road.

- Dispute resolution. At times, disagreements may arise regarding insurance claims or coverage. A service with a strong customer service team will work with you to resolve these issues promptly and fairly, making sure your interests are considered.

- Support availability. Look for insurers who offer accessible, round-the-clock customer support. In the delivery business, incidents can happen at any hour, so it's essential to have support when you need it.

Choose an insurance provider known for excellent customer service and support. It can make a significant difference in how effectively and quickly you can resolve claims or disputes, impacting your peace of mind and business continuity.

Reputation and financial stability

As you explore insurance options, it's essential to research the reputation and financial health of the companies you're considering.

Here's why this is important for you:

- Reputation matters. A company's reputation is a reflection of its customer service, claim settlement policies, and overall reliability. Read reviews, ask for recommendations, and check out customer testimonials to gauge how satisfied others are with their services. This research can give you a clearer picture of what to expect.

- Financial stability is key. An insurance company's financial stability indicates its ability to pay out claims. Especially in uncertain times, you want an insurer that can reliably support you when you need it most. Look into their financial ratings through agencies like A.M. Best or Moody's. A financially stable insurer guarantees that when you file a claim, they have the resources to settle it without issue.

Taking the time to assess these aspects helps make sure you partner with an insurance provider that is both reputable and financially sound, offering you greater security and peace of mind for your delivery company.

Coverage limits and exclusions

Understanding the limitations and exclusions of your insurance policy is crucial. It's about knowing exactly what is and isn't covered, especially in the event of an accident.

Here's how this directly impacts you and your business:

- Coverage limits. Every policy has its limits, which is the maximum amount the insurer will pay out for a claim. If the cost of an accident exceeds this limit, you'll be responsible for the difference. For example, if your policy covers up to $50,000 in property damage and you're involved in an accident causing $70,000 in damage, you'll have to pay the remaining $20,000 out of pocket.

- Exclusions. These are specific situations or types of damage not covered by your policy. Common exclusions might include wear and tear, mechanical breakdowns, or damages occurring during illegal activities. Suppose you're in a delivery accident, but it's discovered you were speeding at the time. If your policy excludes coverage for accidents occurring during law violations, you might not be covered.

By thoroughly understanding these aspects of your policy, you can better assess the risks and make sure you have the right coverage to protect your delivery business in all scenarios.

Additional services and benefits

When choosing delivery insurance, consider the 'add-on' services and value-added features offered by insurance companies.

These extras can significantly benefit your business, whether you're working with Grubhub, Postmates, Amazon Flex, or similar services.

Here's what to look out for:

- Tracking systems. Some insurers offer vehicle tracking systems as an add-on. These systems can help you monitor your deliveries, optimize routes, and even assist in recovering vehicles in case of theft. This feature can be invaluable for keeping operations efficient and secure.

- Delivery assistance. Certain policies may include assistance services like roadside help or vehicle replacement options in case of breakdowns. When you're relying on your vehicle for business, having quick access to assistance can minimize downtime and keep your deliveries on track.

- Customized add-ons for delivery businesses. Look for insurers who understand the unique needs of delivery services. They might offer tailored add-ons that cater specifically to challenges faced by drivers in this sector.

By comparing these additional services and benefits, you can choose an insurance policy that not only protects you but also supports and enhances your delivery business operations.

1. Progressive

Progressive's delivery driver insurance is specifically tailored to meet the needs of drivers like you. It gives you coverage for a variety of scenarios that you might encounter while on the job.

Here's what you need to know about Progressive's coverage for delivery drivers.

Progressive's policy covers the essentials for delivery drivers, giving you protection against common risks associated with driving and delivering goods.

This includes liability coverage for bodily injuries and property damage, as well as coverage for your vehicle in case of accidents, theft, or vandalism.

Pros:

- Customized coverage. Progressive allows you to tailor your policy to suit your specific needs as a delivery driver.

- Flexibility for multiple platforms. Ideal if you work with different delivery services like Uber Eats, DoorDash, or Grubhub.

- 24/7 customer support. Access to customer service anytime, which is crucial in a part-time job that doesn't stick to regular hours.

- Discounts available. You may be eligible for discounts based on your driving record or if you bundle policies.

Cons:

- Cost variability. Premiums can vary significantly depending on your location, driving history, and the type of vehicle you use.

- Coverage limitations. There may be certain limitations in coverage, so it's important to read the fine print and understand what's included and what's not.

- Deductible applies. Like most insurance policies, you'll need to pay a deductible before coverage kicks in, which could be a concern if you're looking for lower out-of-pocket costs.

Understanding these details can help you decide if Progressive's insurance is the right fit for your delivery driving needs, making sure you're well-protected while on the road.

2. State Farm

State Farm offers delivery driver insurance that's designed to give the specific coverage you need when on the road, delivering goods or services.

Here's a clear overview of what State Farm brings to the table.

State Farm's insurance policy for delivery drivers includes coverage for vehicle damage, accidents, and liability.

Their policies are known for offering a good balance between comprehensive coverage and customizable options, making them suitable for a variety of delivery services.

Pros:

- Broad coverage options. Offers wide-ranging protection, including for accidents and liability.

- Personalization. You can tailor your policy to fit the specific needs of your delivery job.

- Strong customer service reputation. Known for reliable support and efficient claims processing.

- Rideshare insurance policies. If you're also involved in ridesharing, you’ll want a policy with rideshare coverage.

Cons:

- Potentially higher premiums. Depending on your specific situation, you might find the premiums higher than some other services.

- Geographical limitations. Auto insurance coverage details and availability can vary based on your location, which might limit your options.

3. Allstate

Allstate's delivery driver insurance is designed to meet the specific needs of drivers like you, offering essential coverage while you're on the job.

Here's a clear overview of Allstate’s offerings.

Allstate’s policy for delivery drivers covers fundamental aspects such as vehicle damage, accidents, and liability.

What sets Allstate apart is its focus on offering customized solutions and additional benefits that can be particularly useful for food delivery drivers.

Pros:

- Customizable policies. Tailor your insurance coverage to fit the unique demands of your full-time delivery job.

- Additional benefits. Offers extra features like roadside assistance, which can be invaluable for delivery drivers.

- Strong reputation. Known for their reliability and comprehensive coverage options.

- Accident forgiveness. Some policies include accident forgiveness, which can prevent your auto insurance rates from increasing after your first accident.

Cons:

- Higher cost for certain features. Some of the additional benefits might come at a higher premium.

- Policy variations by location. Coverage options and availability may differ depending on where you are located, affecting your choices.

4. GEICO

GEICO offers a delivery driver insurance policy that's tailored to the needs of drivers in this field, offering coverage that's both relevant and practical for your day-to-day operations.

Here's a straightforward summary of GEICO’s coverage.

GEICO's policy for delivery drivers covers essential aspects like accidents, vehicle damage, and general liability insurance.

A key aspect of GEICO's offering is its competitive pricing and the simplicity of managing policies online, which is convenient for busy drivers.

Pros:

- Competitive pricing. Known for offering affordable rates, making it a budget-friendly option.

- Online policy management. Easy to manage your policy and file claims online, saving time and hassle.

- Good customer service. Generally recognized for responsive and helpful customer support.

- Discounts and savings. Offers various discounts that could lower your premiums further.

Cons:

- Limited customization. Options for tailoring your policy to specific needs may be more limited compared to other services.

- Coverage specifics. It's important to closely review the policy details, as some necessary coverage aspects might not be included by default.

5. Farmers Insurance

Farmers Insurance offers coverage options specifically for delivery drivers, making sure that you have the necessary protection while on the job.

Here’s a clear overview of what Farmers Insurance offers.

Farmers Insurance policies for delivery drivers cover key areas such as accidents, vehicle damage, and liability.

They stand out for their personalized service and the ability to work closely with insurance agents to tailor your policy.

Pros:

- Personalized service. Direct interaction with agents allows for customized policy solutions.

- Comprehensive coverage options. Offers robust protection for a range of scenarios you might encounter as a delivery driver.

- Reputation for reliability. Farmers is known for its strong track record in insurance services.

- Policy flexibility. Offers flexibility in choosing and adjusting coverage options as your needs change.

Cons:

- Higher premiums for certain plans. Some coverage options may come at a higher cost.

- Availability may vary. Coverage specifics and availability can differ based on your location.

Which delivery insurance is best overall?

Choosing the best delivery insurance depends on your individual needs, preferences, and circumstances. Each insurance provider discussed — Progressive, State Farm, Allstate, GEICO, and Farmers Insurance — offers unique benefits and potential drawbacks.

- If you prioritize customizable coverage and strong customer service, State Farm and Allstate are excellent choices.

- For those looking for more affordable rates with straightforward online management, GEICO might be the way to go.

- Progressive is a good option if you need flexible coverage for different delivery platforms.

- And for personalized service with the ability to tailor your policy closely, Farmers Insurance stands out.

Ultimately, the best insurance for you is the one that aligns with your specific needs as a delivery driver.

It's important to weigh the pros and cons of each service against what matters most for your delivery activities.

Whether it’s cost, coverage flexibility, customer service, or specific benefits like accident forgiveness or roadside assistance, your choice should give the right balance for your peace of mind and protection on the road.

Delivery insurance FAQ

Navigating the world of delivery insurance can be complex, but understanding the basics is key. Below are some frequently asked questions to help clarify your insurance needs as a delivery driver.

What kind of insurance do you need to deliver?

To deliver for most services, you'll need a commercial auto insurance policy, which covers you for business use of your vehicle. This is different from a personal car insurance policy and makes sure you're covered for liabilities and damages while working.

What is the cheapest form of insurance for delivery drivers?

The cheapest form of insurance for delivery drivers typically involves getting a personal auto policy with a business use add-on or endorsement, but this can vary based on individual circumstances.

It's crucial to compare insurance quotes from different services to find the most cost-effective option for your specific needs.

What insurance do you need for DoorDash?

For DoorDash, you need a personal auto insurance policy as a base. DoorDash gives some additional coverage while you have food in the vehicle, but it's essential to have your own insurance for comprehensive protection. Consider adding a business use endorsement to your personal policy for better coverage.

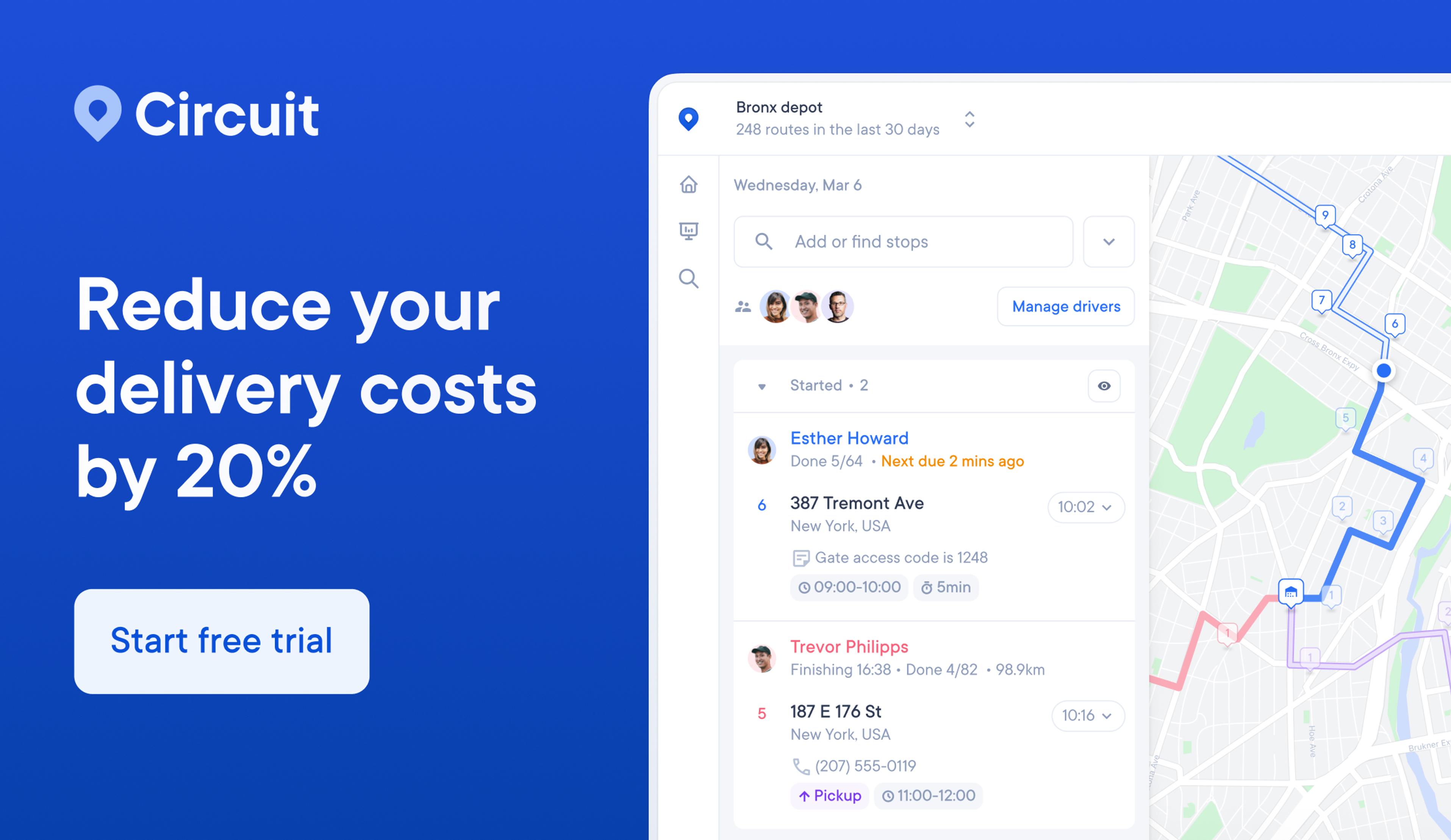

Optimize your deliveries with Circuit for Teams

While selecting the right business insurance for your delivery needs is critical for protection and peace of mind, there's another key aspect to successful delivery operations: optimization.

Streamlining your delivery routes and schedules not only saves time but also money, reducing wear and tear on your vehicle and potentially lowering insurance costs.

This is where Circuit for Teams comes into play. Circuit for Teams offers an advanced route optimization solution that can significantly enhance the efficiency of your delivery operations.

With features like optimized route planning, real-time tracking, and easy rescheduling, you can make sure your deliveries are made in the most efficient manner possible.

By reducing the time spent on the road, you're also lowering the risk of incidents, which can be beneficial for your insurance premiums in the long run.

Moreover, Circuit for Teams integrates seamlessly with various delivery platforms, making it a versatile tool for drivers affiliated with services like Uber Eats, DoorDash, or Amazon Flex.

The ability to optimize routes and schedule deliveries effectively means you can complete more deliveries in less time, increasing your earning potential.

In essence, while good delivery insurance protects you from the unexpected, Circuit for Teams empowers you to manage your deliveries more effectively, reducing risks and costs.

Start optimizing your delivery routes and saving time and money today by signing up for Circuit for Teams.