Loans for Delivery and Rideshare Drivers: Know Before You Apply

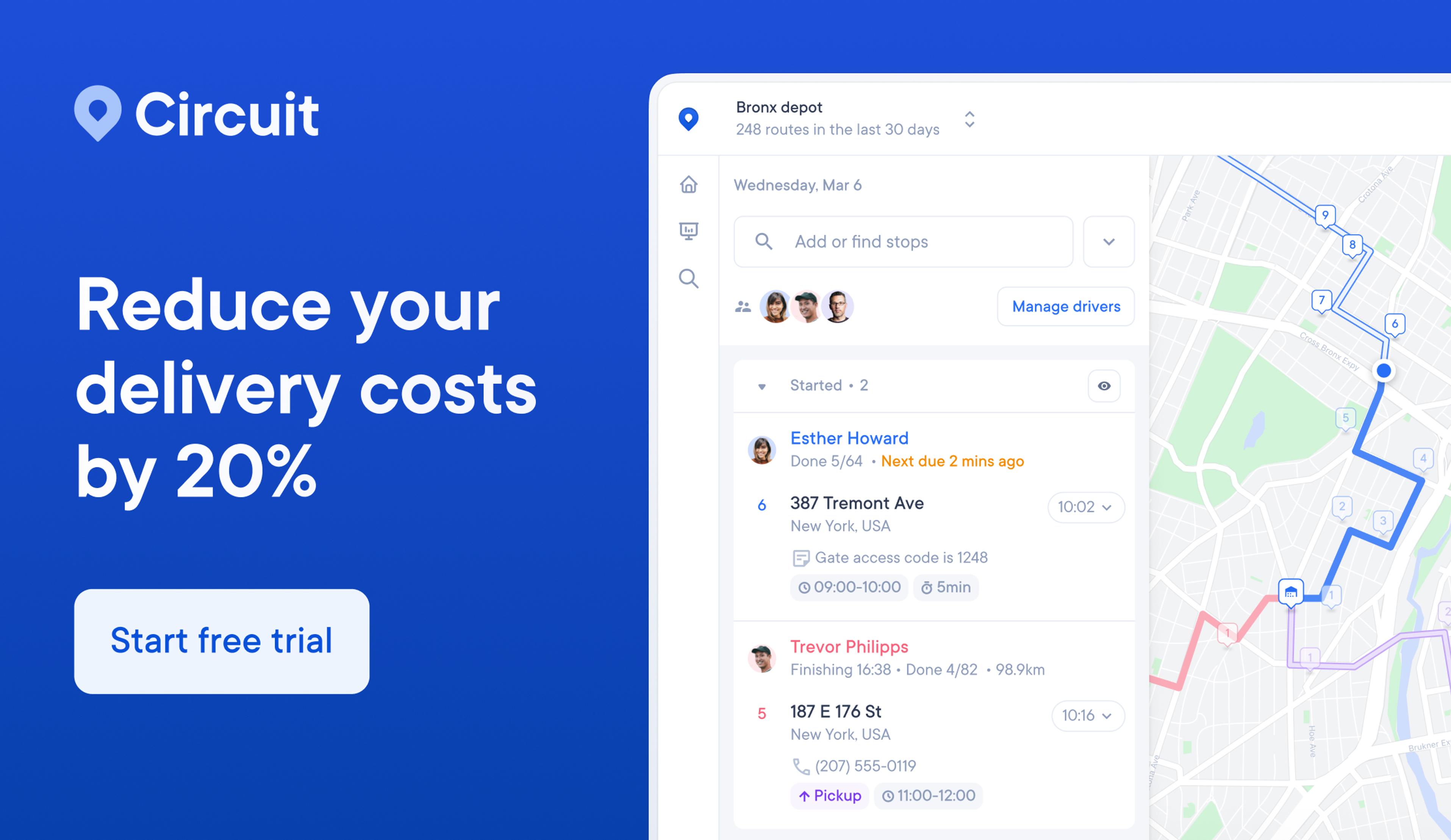

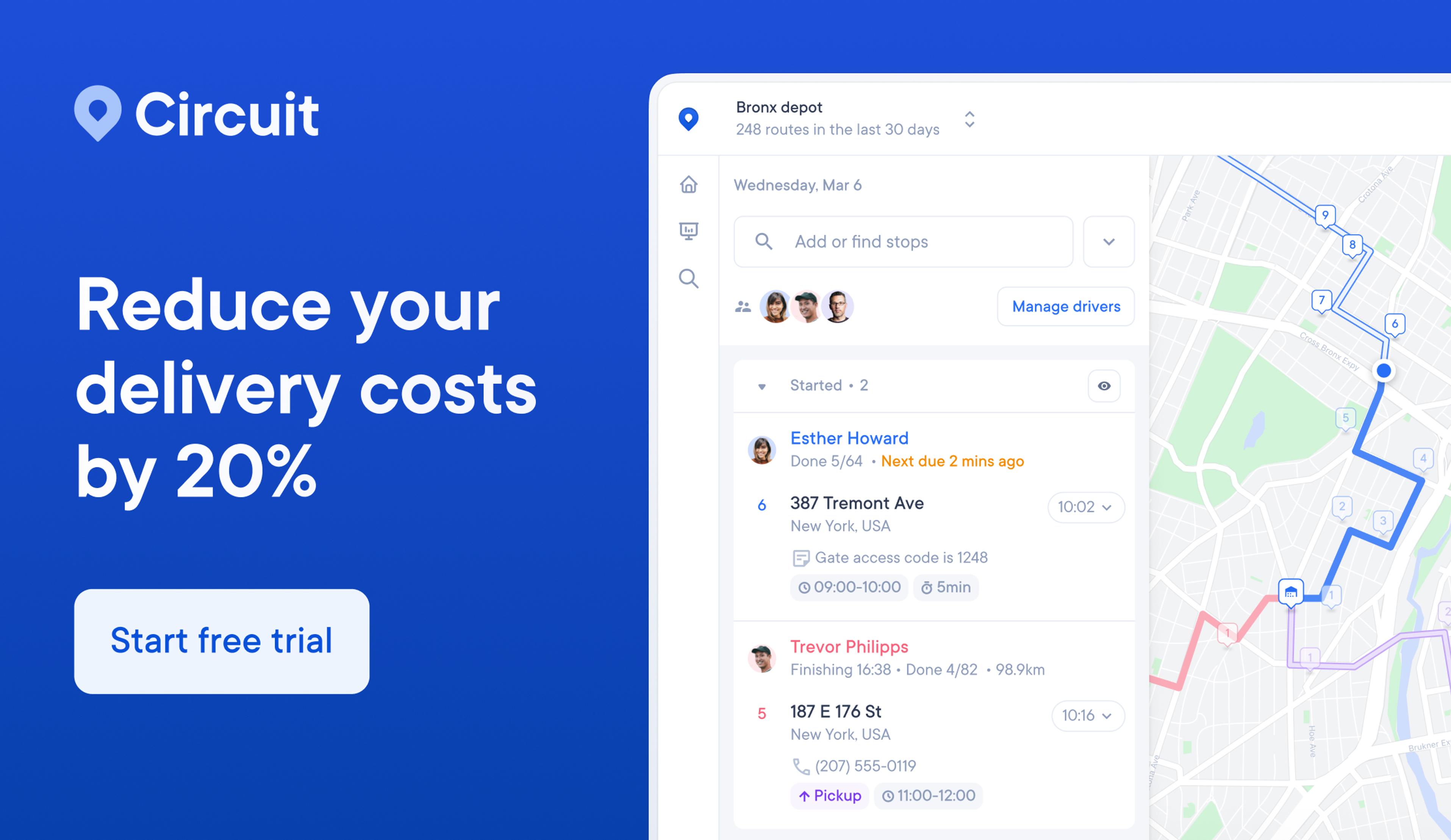

As a delivery or rideshare driver, you can face surprise expenses. One thing that shouldn't be a surprise? Your route. Circuit Route Planner helps you stay on track.

Being a rideshare or delivery driver is often difficult, thankless work. But you do get a lot of freedom.

You can set your own hours, choosing when and where you want to drive — and you don’t have an obnoxious boss to report to each day.

But that freedom also brings added responsibility with it, including financial challenges to keep you on the road.

Usually, independent contractors for DoorDash, Uber, Lyft, Postmates, Instacart, or Grubhub — to name a few — have to deal with operational costs themselves. The company isn’t going to cover your car repairs or smashed phone.

While you can plan for many of these costs, unexpected expenses can sometimes pop up. For example, if you get in an accident and your car needs repairs, you’ll have to pay for those costs out of your own pocket.

Sometimes, you just wish you had a little breathing room. A loan can make it easier to get back on the road faster — and make money.

All of this sounds great, but it brings up important questions: can you get approved for a loan even if you aren’t a formal employee with a steady paycheck? How on earth are you supposed to get a loan? What kind of loan should you consider?

It’s true that there are some special considerations you have to keep in mind when you apply for a loan as a delivery or rideshare driver.

I’m going to demystify the topics and help you understand your options.

Can delivery app and rideshare drivers get loans?

Let’s keep this short and sweet: Yes, delivery and rideshare drivers in the United States are eligible for loans. But a few things can make it harder for drivers to get a loan from a traditional lender.

Don’t panic. There are ways to get a loan.

You just need to learn about the potential hurdles — and possible alternatives — to traditional loans. Let’s get into it.

What makes it difficult for delivery and rideshare drivers to get loans?

Uber drivers, Doordash drivers, Amazon Prime drivers, and others working on a “gig” basis are often considered independent contractors.

Traditional lenders like banks and credit unions might hesitate to extend a loan or line of credit to independent contractors because they don’t always see gig work as giving a stable, steady income.

In the lender’s point of view, this makes it less likely that you’ll pay back the loan, plus interest, in full and on time.

Basically, they see you as a bigger financial risk.

If you have a bad credit score, it can be even tougher to get a loan or credit. Your credit score is based on factors like whether you pay your bills on time.

Lenders and creditors look at credit scores to determine how risky it is to give you a loan. If you have a bad score (usually considered below 670), lenders might see you as high risk — and less likely to get a loan. Read how to improve your credit score here.

Common loan options for delivery and rideshare drivers

If you apply for a traditional loan and are denied, you have other options. These types of loans have less-strict requirements and can be better-suited for delivery and rideshare drivers.

Payday loan/cash advance

A payday loan, also referred to as a cash advance, is a type of short-term loan. It’s designed to cover you financially until your next pay period. These loans are generally smaller (they usually get up to $1,000) and have a short repayment period of one month or less.

When you repay the loan, you’ll have to repay the sum you borrowed, plus any interest and fees. The fees for payday loans can be high, up to as much as 30% (or $30 for every $100 borrowed). This loan can be good for covering basic living essentials until you get your next paycheck.

Just make sure to read the fine print regarding the loan terms and interest.

Pro

- Easy to access

- Fewer requirements than other loans

- No credit check

- Unsecured (so your property doesn’t serve as collateral)

Cons

- High interest rates and fees

- Short repayment terms

- Typically considered predatory lending

- Can ruin your credit if they aren’t repaid on time

Personal loan/short-term installment loan

A personal loan, also known as a short-term installment loan, is a type of financing.

This is a good option if you need more funds than a payday loan can offer, as short-term installment loans go up to $5,000.

You also have longer to pay back the money borrowed — up to several months instead of just one. The repayment is usually structured in fixed monthly installments.

Again, read the fine print about repayment terms, interest rates, and any other fees, such as what lenders will charge in case of a late payment.

Pros

- Higher borrowing limits than payday loans

- Longer repayment periods

- More flexibility in what you can spend the money on

- Can be unsecured (meaning no collateral required)

Cons

- Higher interest rates than some alternatives

- High fees and penalties

- Can be secured (meaning collateral is required)

- Applying may affect credit score

What do lenders consider when delivery/rideshare drivers apply for a loan?

Knowing what banks and credit unions look at during the application process can help you get ready if you decide to apply for a loan. When completing the paperwork, you’ll be asked to supply some basic details like your Social Security number (SSN).

Beyond the basics here are some of the most important points lenders look at.

Credit score

Your credit report is an indicator of your overall financial health. Your credit score is a number on a scale from 300 to 850 that tells lenders at a glance how financially stable you are and how likely you are to repay a loan or line of credit.

Credit scores are based on many factors, including credit ratio (how much credit you have versus how much you use), whether you pay your bills on time, and if you’ve ever declared bankruptcy.

No idea what your credit history is? Pro tip: You can ask for a free copy of your credit report every 12 months from AnnualCreditReport.com

Income

Your income is another major consideration when you apply for a loan. Evidence of a steady stream of income reassures lenders that you’ll have the future funds to pay them back.

Employed people might give pay slips as proof of income. You won’t be able to present pay stubs if you’re part of the gig economy, however, which can work against you.

However, independent contractors can supply other documentation as evidence of income, like bank statements and tax filings. If you have a long history of regular income — not just a few months — you’ll be better off.

How much you want to take out

The amount of the loan you want to take out is another consideration.

If a person who earns an average of $30,000 per year after taxes wants to take out a $100,000 personal loan, banks have a good reason to be wary. However, if that same person wants to take out a $3,000 loan, the bank will be more likely to approve their application.

Again, it’s just a question of risk on the bank’s part — they know that you’ll be more likely to pay back a smaller loan amount.

That said, not all lenders will give you such small loans. Why not? The bank still has the same administrative burden for a small loan as a large one, so they may prefer to issue larger loans with a higher return rate.

How do cash advances work?

Depending on your situation, a cash advance might be your best bet if you’re a delivery or rideshare driver facing unexpected costs.

For example, you can’t do your job without your vehicle. It’s best to take out a cash advance and get any urgent repairs done right away if your car needs a fix. You can then pay the money back once you’re earning money on the road.

Depending on the type of bank account or credit card you have, you might be able to take out cash at an ATM using your credit card and a pin code. You can also visit your bank to request a cash advance upfront.

Convenience checks are another possibility offered by some credit cards. With this option, your credit card gives you “convenience checks,” which you can use to write a check to yourself. You can then deposit the check into your bank account or cash it.

Cash advances are relatively easy to get and have a high approval rate. However, they also come with high interest rates.

Check cash advance terms and conditions, look for hidden fees and disclaimers, and do the math to see what you’ll have to pay.

For example, if you take out a cash advance of $1,000 and have an interest rate of 25%, you’ll have $250 of interest to pay (on top of the lump sum).

How Circuit makes your delivery and rideshare business faster and easier

Money being tight as a Lyft driver or similar gig worker is nothing new. It’s natural to consider the option of getting a traditional loan. But it isn’t always easy. If you don’t pass an initial credit check, for example, your application might be denied.

This can be a real problem if you face unexpected costs — like having to renew your driver’s license — and are strapped for cash.

Don’t worry: Self-employed people and freelancers working for delivery companies have options like cash advances and personal loans.

Money worries can be a huge headache. The last thing you want is to stress about your delivery routes, too.

Circuit Route Planner makes it faster and easier to get through your workday by planning efficient routes for you. Circuit also offers other perks to simplify your delivery gig, like a package finder and proof-of-delivery features.