COGS: What Is Cost of Goods Sold and How to Calculate It

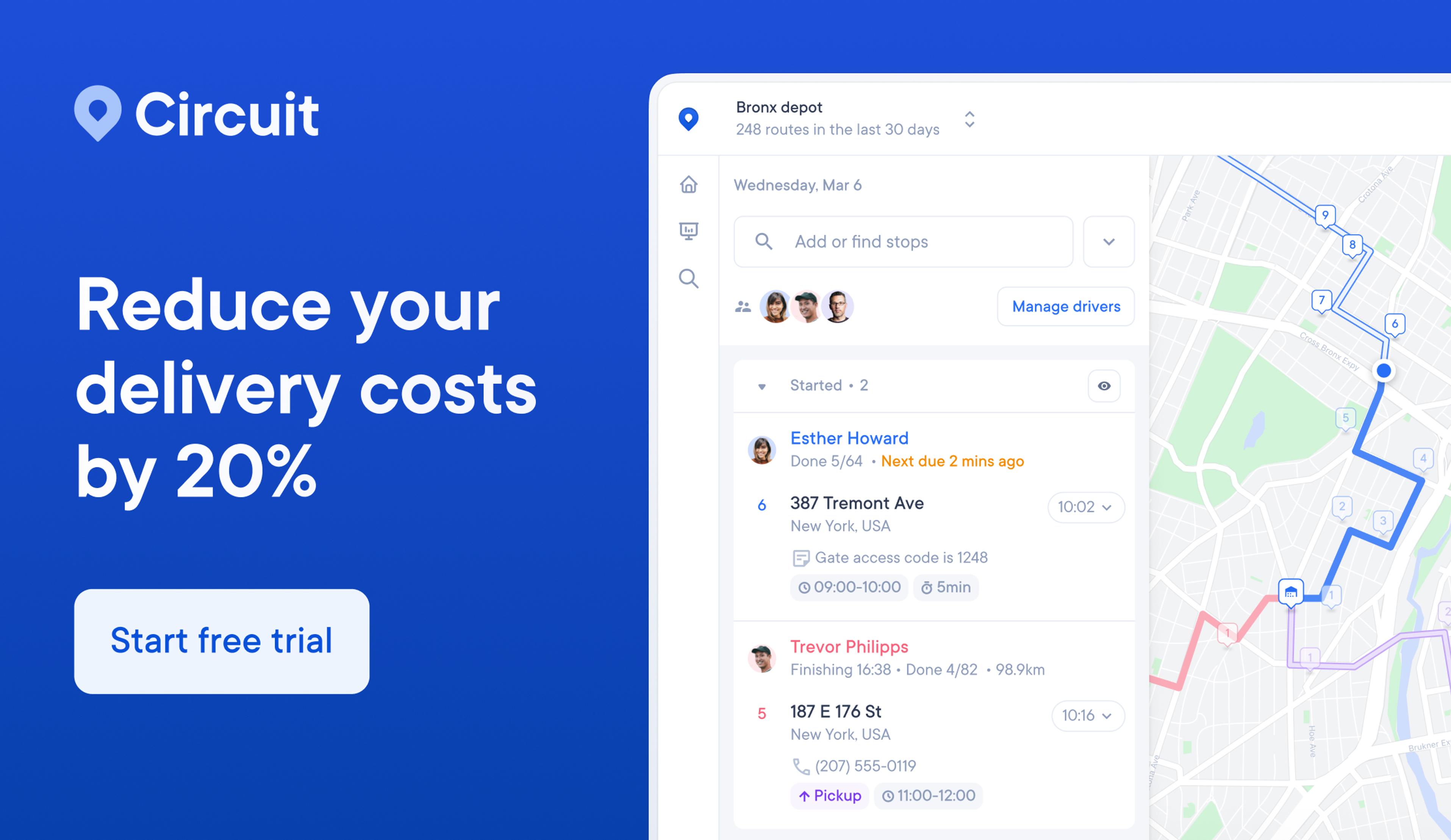

Use Circuit for Teams to automatically create efficient driver routes and give real-time delivery updates to customers.

OK, so you know your cost of goods sold (COGS) is important, but what exactly is it?

COGS is the direct cost of producing items to sell. It’s important because it tells you how much it costs to do business and helps you decide how to price your items.

This article breaks down everything you need to know about COGS.

By the time you finish reading, you’ll know how to calculate your business’s COGS and how to include it in your taxes.

Key takeaways:

- COGS includes direct costs associated with production, such as labor and materials.

- COGS doesn’t factor indirect costs such as management salaries and marketing and advertising fees.

- Your inventory valuation method (for instance, FIFO or LIFO) impacts your calculated COGS.

- You can find your COGS by adding your raw material costs, labor costs, and any other direct costs necessary to make your product.

What is COGS (cost of goods sold)?

As a business, you make money by producing and selling goods. Keep the cash flow going strong and everyone is happy.

COGS is important because it tells you how much you spend to make the things you sell.

Knowing your COGS helps you produce accurate balance sheets while impressing everyone with how much you know about accounting principles.

Maybe you’ll even get to keep some of the saved cash as a bonus!

Remember that your COGS only includes direct costs like parts and labor. Sales, marketing, and breakroom snacks are indirect costs that don’t factor into your COGS.

Should you still have snacks in the breakroom? Yes, absolutely. But that’s not the point.

This is why retailers and wholesalers don’t use COGS. They may have a cost of sales instead, or they may track both numbers if they are making and selling products.

When including labor in your COGS, make sure you’re only considering production-related labor. Labor unrelated to production is an operating cost, not a production expense.

COGS directly relates to production. If your production volume goes up, your COGS goes up, too. This makes it a variable cost.

COGS is an important number for companies that make products. If your business is in manufacturing, transportation, food, agriculture, construction, aerospace, or telecommunications, COGS is probably a big deal.

Many companies understand that their COGS matters but don’t know how to calculate it. That’s why we’ve written this piece.

Keep reading to get the information you need about how to find your exact COGS so you can bring your business to the next level.

What’s included in COGS?

Let’s get into a little more detail about what expenditures you should (and shouldn’t) include in your COGS to get an accurate number.

Here are some costs that make up your COGS:

- Cost of resale items. How much do you spend buying the items you plan to resell?

- Cost of raw materials and parts. What does it cost to buy the parts that you’ll use in manufacturing?

- Direct labor. What do you pay the people who assemble the items you sell? These are your direct labor costs, and they are a big part of your COGS.

- Supplies used for making or selling the product. These may not be parts or materials, but they are essential tools that you use in manufacturing.

- Shipping and freight costs. Once your items are ready to go, you have to get them to the client.

- Overhead costs. Some expenses outside of labor and manufacturing are still considered direct expenses. These can include the cost of machine maintenance, property taxes on your warehouse, and any computer equipment you use during production.

And here are a few things to leave out:

- Advertising costs. Does it help you sell? Depends on how good your advertising is. Is it a direct cost? No, because it’s not directly connected to production.

- Management salaries. This is another important expense for your business, but not a direct factor in your COGS.

- Administrative fees. Things like accounting software, office supplies, and legal fees don’t factor into your COGS, although you’ll definitely want to keep track of them for tax purposes.

How to calculate COGS

Calculating COGS is pretty simple, and you can use one of multiple formulas. We’ll cover one of our favorites in the following section, but we also want you to know about a few other examples that businesses often use.

Here’s one of the most common formulas: Take your beginning inventory, add your cost of goods, and subtract your ending inventory. The result is your COGS.

(Beginning inventory + cost of goods) - Ending inventory = Cost of goods sold

Pretty easy, right? We didn’t even use multiplication or long division. This is just addition and subtraction — stuff we learned back in kindergarten or first grade.

Although it’s simple, we don’t want to leave you in the dust. So let’s break this down in a little more detail.

Your beginning inventory is a number you usually calculate at the beginning of the year. It’s the value you already have on hand.

The cost of goods is what you spend during the year to bring in or produce new items. Consider what you spend on each of your direct expenses (which you learned about above) throughout the course of the year.

At the end of the year, you’ll redo inventory to see what you have remaining after inventory turnover from the prior year. This is the same number you use as your beginning inventory the next year.

If you aren’t digging this particular method, you can figure out your COGS by tracking units made and changes in inventory.

Think about it like this: Imagine you’re a company that produces insulated water bottles. In one month, you make 5,000 units, and your inventory decreases by 1,000. You add these two numbers together to get 6,000, which is the number you use for your COGS.

If inventory increases, you subtract the number from production. If you made 5,000 water bottles but inventory increased by 1,000, you’ll use 4,000 to determine your COGS.

Let’s talk about a couple more concepts that factor into your COGS. These key players have to do with how you evaluate your inventory.

There are two common approaches. The first is the first in, first out (FIFO) method.

A FIFO approach makes it easy to track your COGS because you’re working from your oldest inventory cost.

The FIFO method is pretty simple — you sell the items you purchased first. Businesses like FIFO because it matches the natural flow of production.

They also like it because they can easily address cost increases. If the COGS goes up over time, you can change the price of your current inventory even if the production expense increases or decreases.

Pretend you’re a company that produces running shorts. You purchase 100 pairs at $5 per unit. A month later, you buy another 100 pairs at $7.50 per unit.

Then, you sell 50 pairs of shorts. According to the FIFO approach, you sell your older inventory first (which cost you $5 per unit).

Here’s the bottom line: You can charge the same price for your $5 shorts that you plan to charge for your $7.50 shorts because you know where the cost of materials is headed.

FIFO is not a perfect inventory valuation method, but it’s one a lot of businesses like. Still, some don’t.

Another option you have is last-in-first-out (LIFO). This is basically the opposite of FIFO. Some businesses like LIFO because of its tax advantages.

With a LIFO approach, you sell the newest items first. Returning to the previous example, the $7.50 running shorts (not the $5 running shorts you initially purchased) are the first to go. Obviously, this only works for items that don’t have a shelf life.

Because you’re selling your more expensive items first, you’ll probably track a higher COGS unless you sell out of your entire inventory. LIFO also isn’t allowed by the IFRS, which is something to keep in mind if you do business internationally.

The formula for COGS

Here’s one more formula for calculating your COGS:

COGS = raw material costs + labor costs + any other direct costs

The cool thing about this formula is you can see exactly how much you spent on producing your goods.

You can also track any accounting period, whether a full year, a specific month, or something in between.

Raw material costs are what you spend on manufacturing supplies. These products and components are essential for production.

Labor costs are what you pay the people who produce these items. This is different from administrative or management salary costs because they play a direct role in manufacturing.

It’s important to include all other direct costs in your COGS, as well.

An example of COGS

Imagine you’re calculating the COGS of your microwave production.

Each microwave costs $20 to make. The materials cost $10, the labor costs $5, and you average the additional direct costs to around $5 per unit.

Here’s how your COGS formula would look:

COGS ($20) = raw material costs ($10) + labor costs ($5) + any other direct costs ($5)

Looking at this cost of goods sold formula, you can see why a higher or lower cost in any of these areas would directly impact your COGS.

For example, if you figured out how to cut your labor costs by $2 per unit, you would decrease your COGS from $20 to $18.

Next up, we’ll look at how to incorporate COGS information into your accounting methods.

How to correctly record COGS in accounting

Many businesses misallocate costs on their income statements, which can lead to issues when it comes time to file taxes.

Not you, though. Since you’re reading this article, you’ll be one step ahead of the game.

One of the most common mishaps is filling labor expenses under selling, general, and administrative expenses (SG&A). Since labor is a direct expense, it should go under COGS.

This is also important because it shows you exactly how much your product costs to produce. You can’t make your goods and items without labor, so you must include this expense in your COGS.

Take time to look through your financial statements and make sure that any direct production costs are listed under your COGS and not in the wrong category.

How does COGS affect your business taxes?

If you didn’t already know, you have to report your COGS on your taxes. The IRS asks you to list this number so you can write it off your business expenses.

Wait, so calculating my COGS is actually a cost-saving measure?

Yes, in more ways than one. By knowing your COGS, you can write the number off your business taxes and reduce your tax bill. You can also look for ways to cut specific categories in your COGS to limit the amount of money you spend on production.

You must know your beginning- and end-of-year inventory to take the tax write-off. This number plays a critical role in your COGS calculations. It also shows exactly how much inventory you move each year.

A higher COGS means you’ll pay less in taxes but won’t bring in as much profit. This is why some companies prefer LIFO inventory valuation. The higher COGS means they pay less in taxes.

What does COGS tell you about your business?

Your COGS tells you how much you’re spending on production. It also tells you your gross profit.

Subtract your COGS from your revenue to figure out your gross profit margin. This is what you have left over to pay fixed expenses like income taxes.

Most healthy companies have a total cost of goods and services ranging between 50 percent and 65 percent of their total revenue. If your COGS is higher or lower, you may need to take a closer look at things to tighten up the ship.

You may want to address the following categories if your COGS is too high or low:

- Misallocated expenses. Do you have the right expenses in your COGS, or is something in the wrong category?

- Production costs. How much are you spending on production, including the cost of raw materials?

- Overall efficiency. You’ll spend less on labor if your processes are efficient and maximized to their full potential.

- Pricing strategy. Your pricing strategy should accurately reflect your COGS to make sure your bases are covered.

Consider processing a financial statement each month to track your COGs. You can compare each monthly statement with the month before or the same month from last year.

Another trick is to compare your actual COGS with what you budgeted at the beginning of the year. This helps you see whether you’re on track with your projections.

If things are going as planned, that’s great. If not, what changed? Why aren’t your numbers matching what you expected?

Don’t wait until the end of the year to evaluate your COGS. By then, it may be too late, and you may finish the year at a loss.

If you check in on a monthly basis and notice that something isn’t right, you still have plenty of time to take action.

Cost of goods sold FAQs

This is a lot of information. It’s easy to get lost in new terms and definitions. But hopefully our article is helping you understand what makes up your COGS.

You may still have some questions, though. That’s cool! We’ll try to cover many of them before wrapping up so you can go forth and prosper.

What’s the difference between the cost of goods sold and operating expenses?

COGS directly connects to specific products and whether they sell. As we talked about before, this usually includes parts, labor, and other production-related expenses.

Operating expenses reflect the company’s day-to-day operations. It’s the money you spend to keep the lights on and pay employees who aren’t directly involved in labor.

Let’s say a fast food restaurant sells a double cheeseburger. The COGS includes the meat, cheese, bun, veggies, wrapper, and anything else needed to make that burger.

Operating expenses in this scenario could be the cashier’s hourly salary and the cost of cleaning supplies to keep the dining room tidy.

Do they help you sell more cheeseburgers? Yeah, probably.

Are they directly connected to production? Not necessarily.

Are salaries included in COGS?

Do they directly correlate with the production of goods? If so, yes.

You’ll want to include labor costs in your COGS, but you’re better off leaving out administrative and management salaries.

While they are important for the sustainability of your business, they don’t directly impact the production of goods (well, not enough to include them in your COGS).

What’s the difference between COGS and production costs?

So yeah, these two numbers are pretty similar. This is largely because “production costs” is an ambiguous term that doesn’t have a universal definition.

Some people only include labor and material costs in their production cost calculations. This makes it different from COGS, which includes any of your direct costs.

If you’re tracking production costs (or using the language in your business), you’ll want to make sure everyone is on the same page about what’s included and how you’re using it.

Differentiating between the cost of inventory and COGS is another point of contention for some business owners who can’t understand why we need so many damn terms that mean similar things.

Hey, we get it. It’s a lot to remember. Thankfully, there’s really only one thing you need to know about what makes these two terms different.

Inventory costs are related to what you have on hand right now. Some companies don’t feel like there’s much benefit to tracking these numbers, and they save the accounting until it’s time to figure out their COGS.

What’s important to know is that you can’t include an item in your COGS until it’s sold. However, you can include it in your inventory cost.

How does inventory affect COGS?

Once you sell an item, you’ll remove its value from your inventory and add it to your COGS.

Imagine you sell an item in December. On your income statement for that month, deduct the item from inventory and add the direct cost to your COGS.

Obviously, the specific cost varies based on various factors. The cost you track depends on how you manage inventory value. This could be FIFO, LIFO, or a weighted average cost.

Managing order shipments yourself? Find out how Circuit for Teams can help

Your COGS is an important number that reflects your business’s profitability. A lot goes into calculating your COGS. Once you understand what it is and how to find it, you’ll find that keeping track of this metric is a breeze.

Looking for more ways to cut down on business expenses? Try Circuit for Teams. We’ve developed a product that helps small businesses cut delivery costs by as much as 20 percent.

You’ll also enjoy features like optimized delivery routes for drivers, real-time notifications for customers, and proof of delivery features (like photos and customer signatures).