Activity-Based Costing: Pros, Cons, and Examples

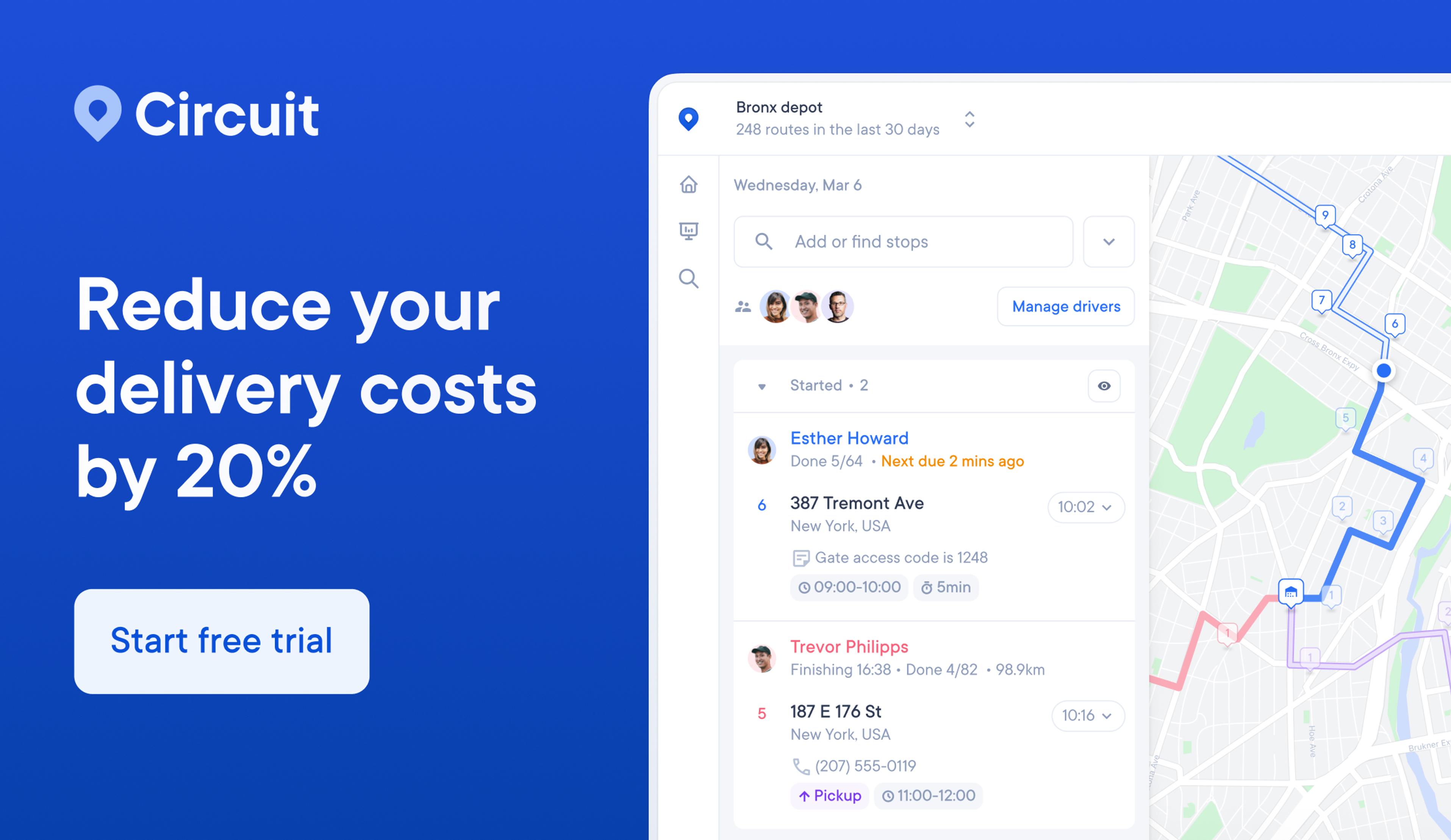

Reduce delivery costs by 20 percent with Circuit for Teams.

Are you tired of guessing the true cost of your business’s products or services? Have you ever wondered where your overhead expenses are really coming from?

If the answer is yes, you might want to start using activity-based costing (ABC).

This innovative method offers a more accurate and detailed understanding of how you’re using resources and racking up costs.

But what exactly is activity-based costing? How does it work? And what are the pros and cons?

In this post, I’ll dive deep into the world of ABC and offer examples of how you can use it.

By the end of this read, you’ll be an ABC expert, equipped with the knowledge and tools to take your organization’s profit margins and decision-making processes to the next level.

Let's start uncovering the magic of the activity-based costing process.

Key takeaways

- Activity-based costing is a more accurate method of assigning costs to products and services by identifying the activities that contribute to the costs.

- While using ABC has benefits, such as more precise cost allocation, improved process efficiency, and better decision-making, it also has drawbacks, such as the potential for increased complexity and costs.

- ABC might be most appropriate for companies with complex and diverse production processes or high overhead costs.

What is activity-based costing?

Activity-based costing (ABC) is a costing method that assigns costs to specific activities or tasks within the production process.

Unlike the traditional costing method, which allocates overhead costs based on broad categories, the ABC system offers a more accurate understanding of how you use resources and incur different types of costs.

This means you can finally say goodbye to broad, inaccurate cost allocations and hello to a more detailed and precise picture of your business’s expenses.

By understanding which activities drive the most costs, you can identify areas to improve efficiency and reduce waste.

It can help you determine important figures like your ideal minimum order quantity (MOQ) and economic order quantity (EOQ).

Activity-based costing formula

Use this simple formula to calculate activity-based costing:

Cost pool total / Cost driver = Activity-based costing

- Cost pool total. This refers to the total cost of a specific activity or group of activities within the production process. For example, the cost pool total for a manufacturing department might include the costs of labor, materials, and equipment related to production.

- Cost driver. A cost driver is a factor determining the cost of a particular activity or process. Cost drivers can vary depending on the activity measured. Common examples include labor hours, machine hours, or units produced.

- Activity-based costing. This is the final result of the formula, which you can determine by dividing the total cost pool by the cost driver. The result gives you a more accurate understanding of each activity’s cost, allowing you to make more informed decisions about pricing, production, and resource allocation.

The 4 types of activity-based costing activities

You can divide activity-based costing into four main groups.

Identifying and assigning costs to each activity lets you better understand the cost of your products or services and make more informed decisions about pricing specific products and resource allocation.

This can help promote better customer satisfaction since they can find what they need (and often at a cheaper price).

- Unit-level activities. These activities are performed for each unit produced or service rendered. Examples include direct labor and direct materials costs, machine hours, or other equipment usage costs.

- Batch-level activities. These activities are performed for each batch of products or services produced or rendered. Examples include setups, inspection costs, or material handling costs that pop up each time you produce a new batch.

- Product-level activities. These activities support a particular product or service line. Examples include product design, engineering, or marketing costs specific to a particular product.

- Facility-level activities. These activities support the entire organization or facility. Examples include facility rent or depreciation, security costs, or general administrative costs not directly associated with a particular product or service line.

Pros and cons of activity-based costing

While activity-based costing is a powerful costing method that can give you valuable insights into your business’s total overhead costs, it’s not without its pros and cons.

In this section, we’ll explore the advantages and disadvantages of the ABC method so you can decide if it’s the right costing method for your business.

Pros of ABC costing

- Accurate product costing. ABC offers a more accurate picture of a product’s true cost by considering the direct costs associated with each activity in the production process. This allows for more accurate costing and pricing decisions and can help you identify which products are most profitable (meaning you can make more money).

- Efficient resource allocation. By identifying the cost drivers for each activity, ABC can help you identify areas where you can improve efficiency and reduce waste. For example, if you run a factory, ABC can help you make informed machine setup decisions.

- Improved decision-making. ABC allows you to make more informed pricing, production, and resource allocation decisions. ABC can help you make more informed decisions about what a customer is likely to purchase and at what price, leading to increased profitability and better decision-making.

- Identify inefficient processes. ABC can help you identify inefficient processes and target areas for improvement. For example, ABC can help you identify cost drivers (that is, areas where employees aren’t working efficiently enough) and find ways to improve.

- Better understanding of manufacturing overhead. ABC gives you a better understanding and justification of costs in manufacturing overhead, allowing you to better manage and control costs. Manufacturing overheads include the depreciation cost of machinery, electricity, and salaries of employees who run your machinery.

Cons of ABC costing

- Time-consuming. ABC can be time-consuming, as it involves identifying all the activities and cost drivers associated with each product or service. This can be daunting, particularly for larger businesses with complex management accounting.

- High cost. ABC can be costly, particularly for smaller businesses or those with limited resources. The costs associated with using the accounting method may outweigh the benefits, especially if you have relatively simple operations.

- Complex methodology. ABC can be a complex method, so you may need specialized knowledge and expertise to use it effectively. This can be a barrier for businesses with limited resources or expertise in accounting or financial management.

- May not fully capture overhead costs. While ABC can offer a more accurate picture of manufacturing overhead costs, it may not capture all expenses and indirect costs. This can lead to incomplete or inaccurate overhead rate information. You might overcharge customers if your data is inaccurate. This might lead to customers switching to competitors since your prices are comparatively higher.

3 examples of activity-based costing

Now that you have an idea of what ABC is all about, it’s time to understand how it works in real life.

Let’s take a look at three examples to give you more insight into the costing system.

Example 1

Let’s say a company called Trendy Clothing produces and sells T-shirts.

Here’s how the business might use activity-based costing:

Let’s say the first unit-level activity is cutting fabric, and the total cost is $10,000.

The cost driver for cutting fabric is the total yards of fabric used. Let’s say Trendy Clothing uses 2,000 yards of fabric for its T-shirts.

So, the activity-based costing is:

$10,000 (cost pool total) / 2,000 yards (cost driver) = $5 per yard

Based on this calculation, the activity cost for cutting fabric for T-shirts is $5 per yard.

Trendy Clothing would repeat this process for each activity and cost driver to determine the activity-based costs for each product line.

Example 2

Let’s say a company called XYZ Manufacturing produces and sells two types of power tools: electric drills and cordless drills.

The company uses ABC costing to allocate manufacturing overhead costs to each product line based on the activities consuming those costs.

Let’s say the total cost for product design for both product lines is $20,000.

The cost driver for product design is the total hours spent on design. XYZ Manufacturing spends a total of 2,000 hours on product design.

Activity-based costing:

$20,000 (cost pool total) / 2,000 hours (cost driver) = $10 per hour

Based on this calculation, the activity-based cost for product design is $10 per hour.

Example 3

Now, we offer a slightly more complicated example so you can learn how a business might use ABC pricing to determine which product is more expensive to produce.

Let’s say a small business produces two products: Product A and Product B.

The business has identified three cost pools used to allocate overhead costs: direct labor, machine setup, and quality control.

- Direct labor cost pool = $100,000

- Machine setup cost pool = $50,000

- Quality control cost pool = $25,000

The business also identifies three cost drivers for each cost pool:

- Direct labor hours = 10,000 hours

- Number of machine setups = 500 setups

- Number of quality control checks = 100 checks

We can calculate the overhead cost per unit for each product using the ABC costing formula:

Assume these are the numbers for Product A:

- Direct labor hours = 5,000 hours

- Number of machine setups = 250 setups

- Number of quality control checks = 50 checks

Use the formula above, but multiply it by the number of hours, setups, and checks. Here’s a calculation for Product A and Product B:

($100,000/10,000 hours x 5,000 hours) + ($50,000/500 setups x 250 setups) + ($25,000/100 checks x 50 checks) = $5 + $50 + $125 = $180

Assume these are the numbers for Product B:

- Direct labor hours = 2,500 hours

- Number of machine setups = 100 setups

- Number of quality control checks = 20 checks

($100,000/10,000 hours x 2,500 hours) + ($50,000/500 setups x 100 setups) + ($25,000/100 checks x 20 checks) = $2.50 + $10 + $12.50 = $25

By using activity-based costing, the business understands that Product A has a higher overhead cost per unit than Product B.

This information can help the business make better decisions about budgeting, product pricing, and resource allocation.

When does it make sense to use activity-based costing?

Activity-based costing is a useful costing method in specific business situations.

We’ll go over some scenarios where it makes sense to use activity-based cost accounting:

- ABC costing is effective when your overhead costs are a significant portion of the total cost of production. This is because the traditional costing method may not accurately capture your overhead costs, leading to incorrect pricing decisions. Customers may stop buying from you since your products are more expensive than those of businesses selling similar products.

- When products or services have diverse overhead costs, ABC costing can help identify the actual costs of each product or service. This is because ABC costing allocates overhead costs based on the specific activities the product or service consumes.

- ABC costing is useful when the production process involves multiple activities, and accurately allocating overhead costs to each activity is difficult. By identifying the cost drivers for each activity, ABC costing can allocate overhead costs more accurately.

- In complex business models, ABC costing can help identify inefficiencies and unnecessary costs. This information can help you make better decisions about resource allocation and pricing.

Managing your own deliveries? Circuit for Teams optimizes the process

In today’s competitive business environment, accurately understanding your fixed and variable costs is crucial for success.

That’s where the activity-based costing system can help.

By giving a detailed breakdown of costs and the activities that drive them, the accounting system can help you make more informed decisions about pricing, production, and process improvements.

And customers are more likely to continue buying from you because they’re getting products they want at a competitive price.

Want another way to boost customer satisfaction? Consider Circuit for Teams.

Circuit for Teams is a game-changer for businesses looking to optimize their delivery operations.

With features like real-time tracking, route optimization, and electronic proof of delivery (POD), Circuit for Teams can help your business streamline its delivery operations and save time and money.

And with new updates, dispatchers can make last-minute changes to optimized routes and notify drivers to avoid delays or missed deliveries.

Ready to reduce your in-house delivery costs by 20 percent? Try Circuit for Teams free today.